The portal is designed to manage all your loans and insurance policies in one place and activate an active management system in one place. Getting a loan with this repayment schedule is one of the best ways to repay the loan in installments and provide clients with financial relief.

It is convenient to have this feature if you have numerous loans and insurance payments that need to be made within a certain period. As mentioned earlier, MyCoverageInfo tracks all your insurance policies and tests them regularly. When buying a property, the customer can take out a mortgage and home insurance to finance the purchase. Suppose you would like to know your insurance details. In that case, they are available through a website called MyCoverageInfo, which uses the information provided about your credit history to show you what insurances you have.

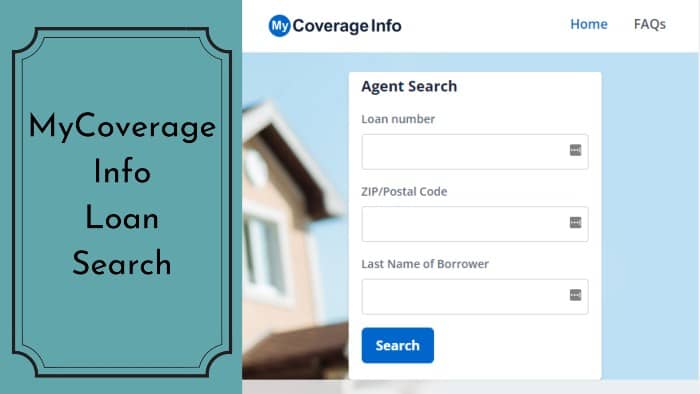

What Is MyCoverageInfo Loan Search System?

You can update your credit information, as well as your insurance policy information, through the MyCoverageInfo portal. Once updated, you can use the portal to track the progress of your insurance policy and notify you or your agent if necessary. With these simple steps, finding your loan and updating your insurance information will be a breeze.

- You can check your balance on the MyCoverageInfo portal at https://MyCoverageInfo.com.

- On the MyCoverageInfo homepage, you will find the “Find a loan” section in the right column.

- You will need to enter your credit number instead of your PIN code, as it is not necessary to provide your PIN code. You can find your credit number on your app or your bank statement.

- Enter the zip code attached to your loan document.

- Your SSN (social security number) consists of four digits.

- Confirm your submission by re-entering your four digits.

- Update your insurance information by clicking the “Search” button.

- MyCoverageInfo allows you to update your agent information, insurance information, personal information, and credit information so that your insurance policy is automatically monitored.